Salary after tax

How to calculate annual income. It can also be used to help fill steps 3 and 4 of a W-4 form.

Income Tax Just Joined Your First Job Here S How Income Tax Is Calculated On Your Salary Business News Income Tax Tax Saving Investment Income

The income tax rules and regulations of that.

. In order to calculate the salary after tax we need to know a few things. And those taken after tax. No matter where in the world youre working from our income after tax calculator will make it easy for you to calculate your net salary.

Just type in your gross salary select how frequently youre paid. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. If your salary is 40000 then after tax and national insurance you will be left with 30879.

For example if an employee earns 1500. If you make 55000 a year living in the region of California USA you will be taxed 11676. That means that your net pay will be 37957 per year or 3163 per month.

Where you live - The municipal tax differs between the. Your average tax rate will be 3067 and your. Free tax code calculator.

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Your gross salary - Its the salary you have before tax.

If your tax code is used to collect the extra tax you do not need to enter your benefits here. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Ad Discover the Best Paycheck Tools of 2022 - Start your Search Now.

How to Use the Tax Calculator for Ireland. Yes you can use specially formatted urls to automatically apply variables and auto-calculate. Your average tax rate is.

Your average tax rate is. Income qnumber required This is required for the link to work. The money for these accounts comes out of your wages after income tax has already been applied.

You can use our Irish tax calculator to estimate your take-home salary after taxes. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. After this you will.

For starters everyone is entitled to earn a set amount of income tax-free. Your average tax rate is. This places Ireland on the 8th place in the International.

Try out the take-home calculator choose the 202223 tax year and see how it affects. Sage Income Tax Calculator. Transfer unused allowance to your spouse.

This is known as your personal allowance which works out to 12570 for the 20222023 tax year. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Its so easy to.

In addition to income. That means that your net pay will be 43324 per year or 3610 per month. The Indian Tax Calculator calculates tax and salary deductions with detailed tax calculations and explanations based on the latest Indian tax rates for 20222023 assessment year.

Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000. Youll then see an estimate of. Just select your province enter your gross salary choose at what frequency youre being paid yearly monthly or weekly and then press calculate.

The reason to use one of these accounts instead of an account taking pre-tax money. Check your tax code - you may be owed 1000s. Thus 359000 annually will net you 248880.

You pay tax on the value of these benefits but not National Insurance. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

This places US on the 4th place out of 72 countries in the. 11 income tax and related need-to-knows. This means you pay 11012000 in taxes on an annual salary of 359000 dollars.

Australian income is levied at progressive tax rates. Calculate how tax changes will affect your pocket. That means that your net pay will be 43041 per year or 3587 per month.

This means that after tax you will take home 2573 every month or 594 per week. It can be any hourly weekly or.

What Is Annual Income How To Calculate Your Salary Income Income Tax Return Salary Calculator

Yearly After Tax Income For 100k Yearly Salary In The United States The Federal Income Tax On A 100k Yearly Salar Salary Federal Income Tax Additional Income

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

Pre Tax Income Vs Income After Tax Your Real Pay Budgeting Money Money Management Advice Pinterest For Business

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Salary Ctc Components And What Is Taxable Financial Planning Income Tax Investing

Salary Calculator Salary Calculator Calculator Design Salary

After Tax Income On 50000 In Canada For 2014 Income Tax Income Earn More Money

Work Out Your Salary After Taxes At Maltasalary Com Salary Workout Tax

Income Tax Calculator Colorado Salary After Taxes Income Tax Payroll Taxes Federal Income Tax

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Salary Life Money Hacks Smart Money

Ctc Salary Structure Income Tax Salary Employment

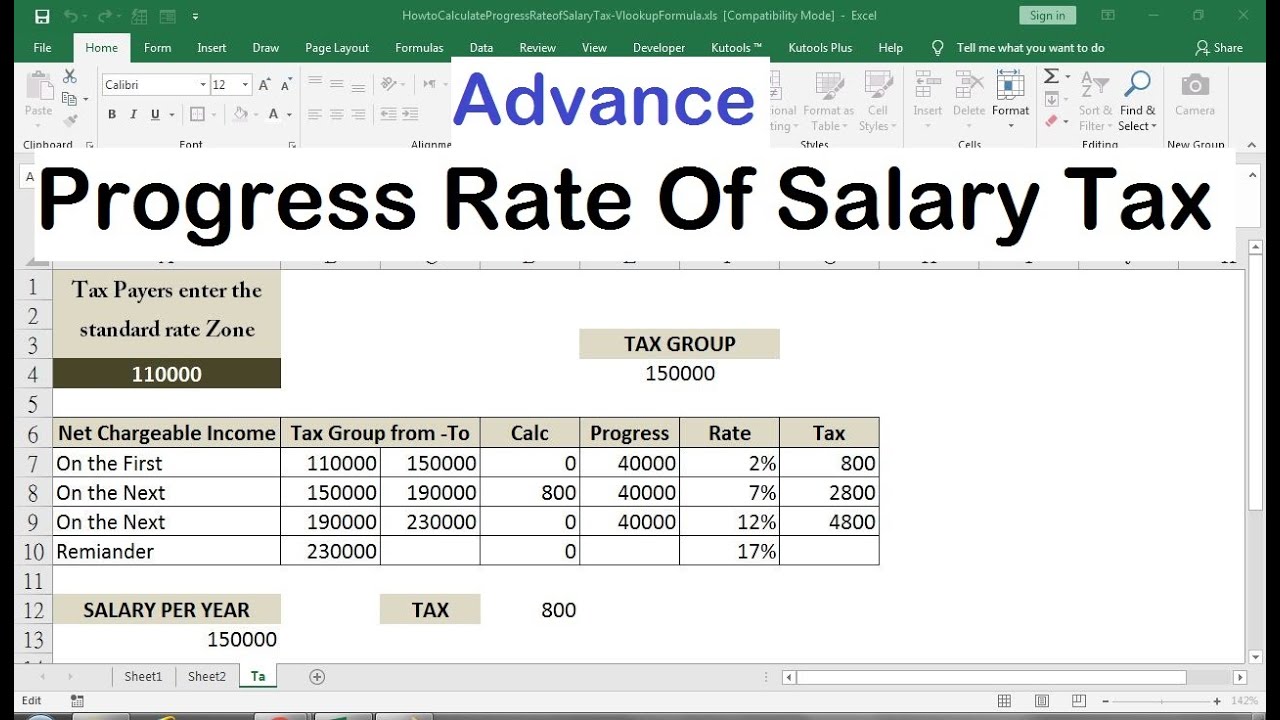

Tax Calculator Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel

Which U S States Have The Lowest Income Taxes Income Tax Income Pinterest For Business

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Decode Your Salary Slip Components And Their Importance Tax Deducted At Source Salary Income Tax

40000 After Tax 2016 Tax Income Tax Finance